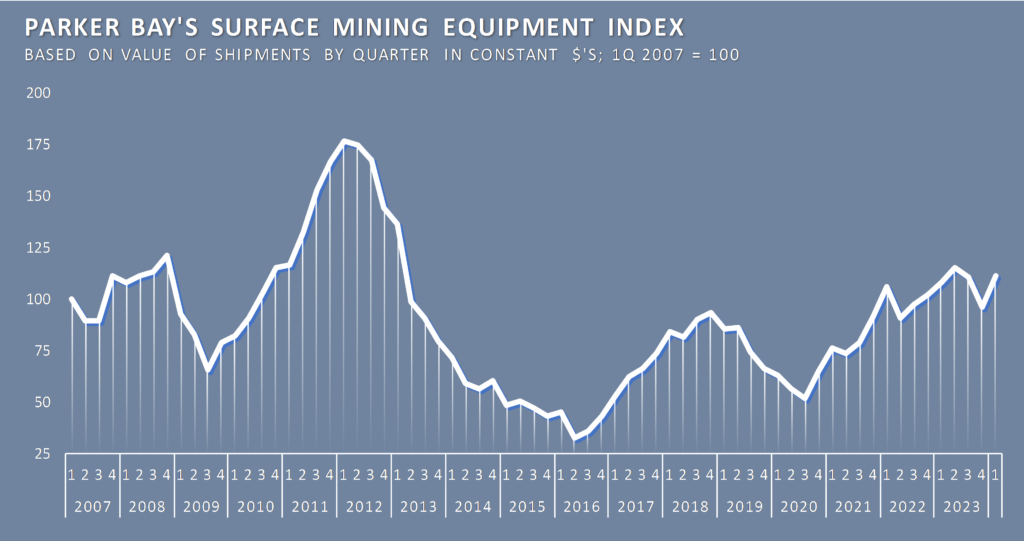

In contrast with the contraction in the second half of 2023, unit shipments in the first quarter of 2024 increased by nearly 10% (+119 units) while the aggregate value of these machines increased by more 16% from Q4, bringing this measure of market value to within 4% of the peak achieved in Q2 2023. We have often pointed out that quarterly data are somewhat erratic and cannot be relied on to measure market trends except over several quarterly reports. It now appears that the order of magnitude of the down cycle may be shorter and less severe. But we continue to anticipate market weakness in 2024 and our evaluation of other measures of market activities reinforce this assessment. But the degree to which Q1 shipments bounced back warrants substantial caution.

Within these aggregates, breaking down Q1 shipments point to some changes of note. Manufacturers’ shipments of large hydraulic shovels/excavators rebounded from a very weak Q4 with unit deliveries increasing by nearly 50% with a comparable increase in value. While the growth in truck deliveries was a more modest 7%, the mix was weighted toward the larger units such that aggregate value of mining truck deliveries increased by 14%. In contrast, deliveries of wheel loaders increased by one-fourth, but the value of these units was virtually unchanged reflecting a shift toward the smaller (20-mt payload) units. Crawler and wheel dozer shipments declined very modestly and this level of deliveries continued the decline in Q4 vs the previous two years’ (-14%).

Geographically, North and Latin American mines recorded extraordinary gains of 26% and 53%. For North America, this is the highest aggregate value of deliveries since 2012 and continues a resurgence in Q4 in the face of declines elsewhere. The increase among Latin America brought deliveries up to a ten-year high. Australasia and Africa, which had been relatively strong during the most recent expansion phase, both contracted modestly during Q1.

Explanation of how the Index is Developed The PBCo Mining Equipment Index is a measure of the quarterly evolution of surface mining equipment shipments worldwide. It relies on data from Parker Bay’s Mobile Mining Equipment Database and encompasses the same product range covered by the Database*. The index utilizes the value of equipment as opposed to number of units such that one $10mm excavator has the same weight as five $2mm trucks. Values are not based on the price of each unit as sold but instead an approximate value assigned to machines by size class and product expressed in constant $’s (updated annually). As such, the index does not reflect changes in equipment pricing but rather the overall sales volume. The base for the index is Q1 2007=100. Quarterly figures are not seasonally adjusted. *All products are included except draglines whose low volume, high $ value, long lead time sales can cause fluctuations that don’t reflect the quarterly changes in the market.

Content retrieved from: https://parkerbaymining.com/industry-information/surface-mining-equipment-index.htm.